Protection

We have been there on the day someone has died, someone was diagnosed with cancer, a child had an illness and insurance gave medical help, a life insurance policy paid into a trust stopping the wrong people/organisations getting funds…

We made these things happen.

BUT..

We have also been called in too late.

“I thought we were covered” “I thought there was more” “Why did the State/Bank/ The Wrong person get this”

To make sure you are covered and FULLY AWARE of what you have, get in touch sooner rather than later so we can help you be at peace and understand what cover you should have in place.

HERE IS HOW WE CAN HELP

Life Cover

Life cover can be put in place either as a lump sum (to clear a loan or mortgage) or as a monthly income to replace the family finances on death.

Consider all the money that comes into your home, we would suggest you cover about 75% of that. This would allow the survivor the ability to continue on and not worry about the monthly bills. In many cases it gives room to work part time whilst children need take to and from school and after school activities. This is a proven way to really help a family.

Critical illness cover

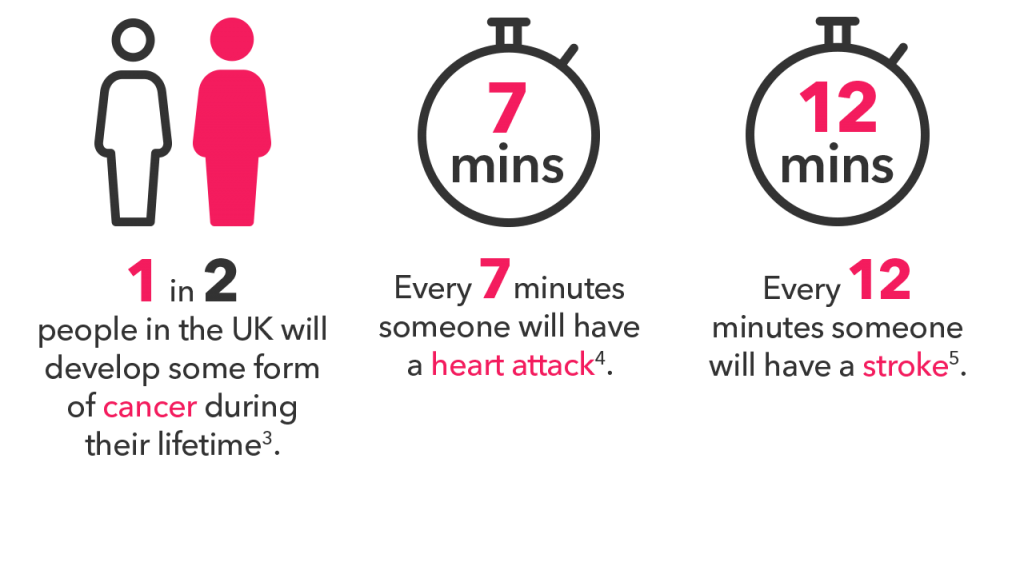

Being diagnosed with a serious illness such as Cancer, Heart Attack, Stroke or Multiple Sclerosis can be devastating. Thankfully critical illness cover has improved dramatically over recent years, making it easier than ever to receive financial help if you’re diagnosed with one of the many conditions that today’s policies cover.

Income protection/ Sickness cover

It doesn’t matter if you are in the office, out running a 5K or even at home caring for your newborn baby. If you get sick or injured and are unable to work then Income Protection will provide a tax-free monthly benefit until you can return to work or reach the end of your benefit period which can stay in place up until you retire ,whichever comes first. Don’t leave things to chance, protect yourself with Income Protection.