Income Protection

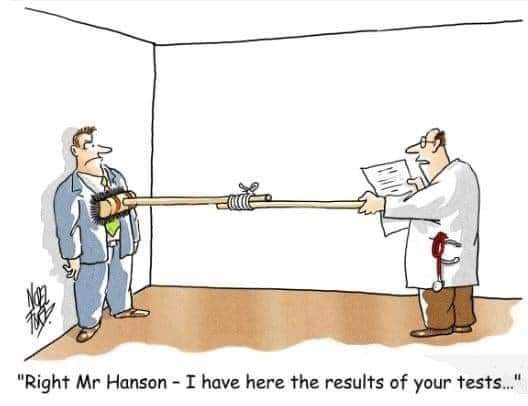

Consider this, 10 minutes ago you took an illness or were injured… you apply to receive £116.75 per week from the Government, enough to fill your car up…now what? Who is going to buy the food, take care of the kids, pay for the things you love to do, eat out, gyms, pets, holidays, Sky/ Netflix/ Disney, after school activities and most importantly how are you going to pay the bills?

Income Protection/ sickness cover can help you with that. It is a policy that pays out 60-70% of your taxable/ proveable income if are unable to work due to illness or injury. You may be able to claim until you return back to work or up to retirement. This plans works in addition to a Critical illness plan if you choose both.

Realistically, no one wants to use there savings to keep them afloat when they are off. Look at your savings and divide it by your monthly income to see how many months you are secure.

Savings should be for enjoyment/ holidays/presents/ hobbies, sickness cover should be for protection. Since 1983 we have had multiple claims which prove these plans really work.

Even if you receive sick pay from your employer, the amount you receive is unlikely to be enough to cover essential expenses. An Income Protection policy is an excellent way to provide additional financial support to help you while you recover.

Employed and self-employed can be covered. It may even be possible to have early access to GP’s and some medical treatments by holding this cover such as physiotherapy and counselling.

Questions

Income protection insurance pays you a regular income if you can’t work because of sickness or disability and may continue until you return to paid work or you retirement age.

The income you get from the policy is tax free.

If your specific condition(s) is covered by both providers then yes you can claim on both to help support you even more.

We recommend for all of our clients to have both of these covers in place for this exact reason.

This depends on how much you have to keep yourself ticking over without dipping into any rainy day funds, you can have the cover pay out from day 1 of illness/ injury or you can extend the deferred period to 4, 13, 26 and 52 weeks if you prefer

Let’s be clear – income protection isn’t the same as the widely mis-sold payment protection insurance (PPI).

Where PPI covers a particular debt and any payouts go to your lender, income protection hands you a tax-free proportion of your income if you’re unable to work because of illness or injury.

We have helped the local people of northern ireland secure their income protection claims from insurers since 1983.

To sum it all up, being off work will cause you significant financial hardship and you are unable to live with that risk, it could be a very worthwhile kind of cover to have in place.

Better to have and not need, than need, and not have.