Critical Illness Cover

This usually pays a lump sum if you are diagnosed with one of around 50+ conditions. We work with most of the top insurers in the UK.

Your children can also be covered for many of these conditions.

Many insurers now offer up to 90 conditions covered with Enhanced cover (which we always recommend) and also access to online /video calls with fast access to GP’s.

BOTH critical illness cover and income protection are policies we recommend to the majority of our clients so that in the event of being diagnosed with a listed critical illness, a lump sum will pay out + you can be at peace financially knowing a monthly income will continue to come in as you take time off work and improve your state of health.

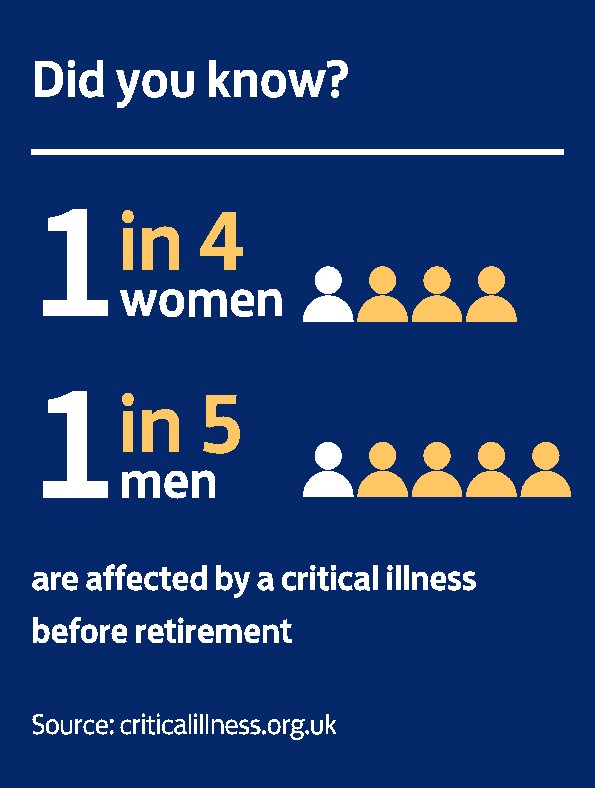

It makes sobering reading but the good news is that many cancers are now survivable. Nevertheless, the impact on your life – your ability to work and look after your family, either financially or in terms of caregiving – remains immense. The financial strain at a difficult time cannot be underestimated.

Childrens Critical Illness Cover

When your child is sick, the only thing that should be on your mind is their recovery. Unfortunately, when a child is diagnosed with a critical illness, there are wider repercussions that can affect more than just their health. Between you taking time off work to attend to your child, to paying for treatments or rehabilitation equipment, critical illnesses can create even more stress in a dire situation for the entire family.

Better to have cover and not need it than to need it an not have it.

Critical illness insurance can bring you great peace of mind. Knowing you’ll have a financial safety net should your child fall seriously ill can allow for economic flexibility in your future plans and safeguard you and your family against the unexpected.

This cover is a proven priority to all parents or soon to be parents.

Your children can be protected from 24 weeks of pregnancy right up until they are 23 years old.

Common Questions.

Critical illness insurance will pay out if you get one of the specific medical conditions or injuries listed in the policy.

The tax-free pay out could help cover your mortgage, rent or other expenses such as medical bills if you’re unable to work due to a critical illness. You’ll be covered for a wide range of illnesses, giving you peace of mind.

Critical illness cover pays out a lump sum if you are diagnosed with an illness that is set out in full terms and policy conditions, whereas income protection cover will pay out a guaranteed income in the event that you are unable to work and will continue to do so until you either die or return back to work. We always recommend having both of these cover in place to protect yourself even more than just having the oWe

A critical illness claim usually takes 4-6 weeks, depending on how quickly the insurer receives the medical evidence they require.

It can be difficult to get critical illness cover if you have a pre-existing condition. This is because insurers will deem you a higher risk of becoming critically ill due to this condition.

We have vast experience in this area as we have been negotiation with insurers since 1983.

You may be able to get critical illness cover with an exclusion in some cases. This essentially means that you will be able to claim and receive a payout for an illness that has nothing to do with your pre-existing condition. Alternatively, you may be able to get cover but may have to pay a higher premium due to the increased risk.

Remember – each insurer is different and with no one-size-fits-all policy. We make multiple applications throughout the panel of insurers to see who offers the best terms.